TurboTax is the industry-leading online tax software. With a clean and logical design, comprehensive deduction discovery tools, and thorough learning resources, TurboTax is a great selection for both simple and complex tax scenarios.

TurboTax automatically identifies sections that might impact your tax situation and presents them in a section titled “Other Tax Situations.” Instead of forcing you to work through these sections in a specific order, you can choose what to work on, and do it in the order you want. The section that identifies deductions and credits operates in a similar manner.

The Premier version of TurboTax adds additional guidance for investments, such as figuring out cost basis for stocks and reporting for stock options and employee stock purchases. If you need to set up business assets, TurboTax offers a step-by-step approach to depreciation.

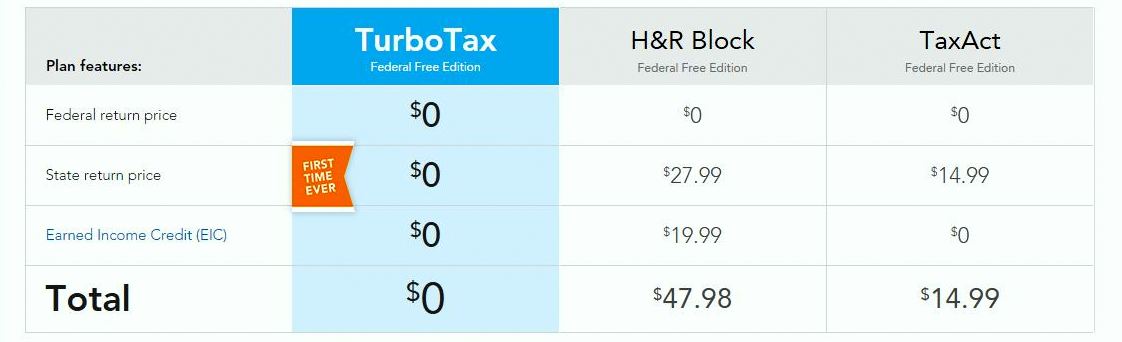

Click here to Start “TurboTax Federal Free Edition” - FREE preparation, FREE printing, FREE efiling for your simple tax return.

Easily get your biggest tax refund possible, guaranteed*

Check out TurboTax today !

*If you get a larger refund or smaller tax due from another tax preparation method, we’ll refund the applicable TurboTax federal and/or state purchase price paid. Claims must be submitted within 60 days of your TurboTax filing date and no later than 12/15/15. Optional add-on services excluded. Cannot be combined with TurboTax Satisfaction (Easy) Guarantee.